Honoring

Our Industry Achievements

Industry

FinanceReal Estate

Platform

Android Mobile Application

iOS Mobile Application

Technology Stack

Objective-C for iOS Application

Swift for iOS Application

Overview

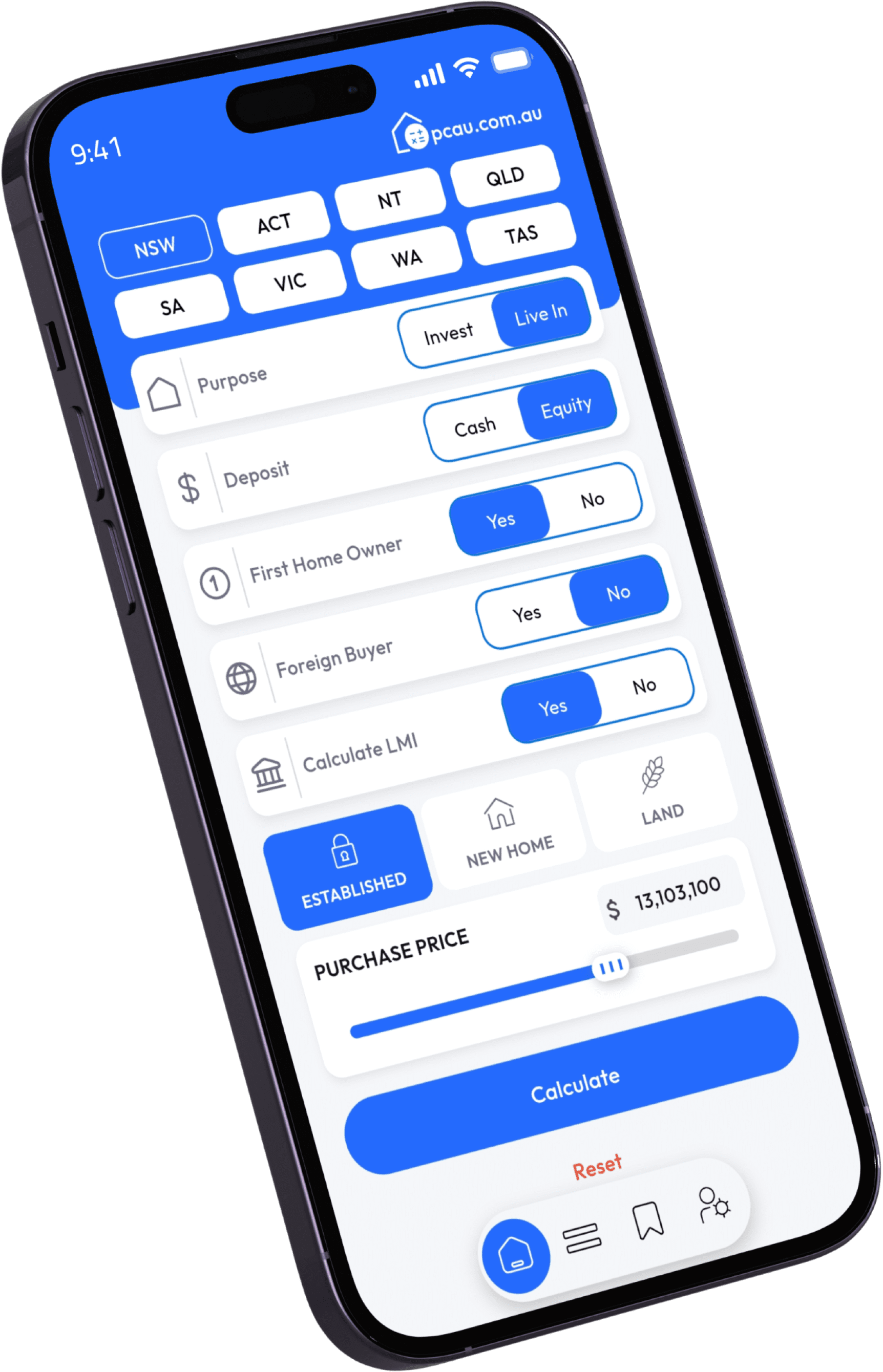

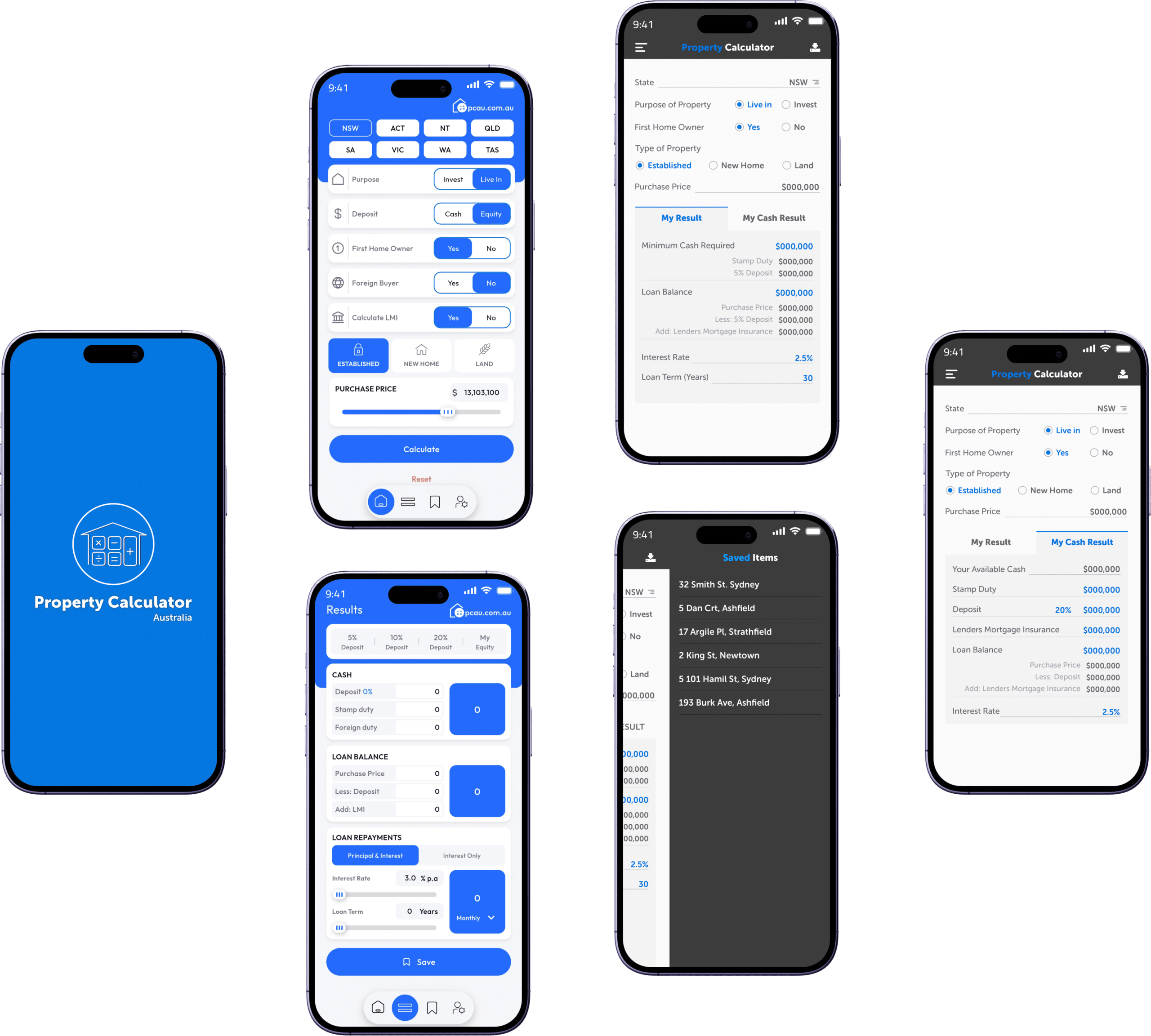

All-in-one property calculator.

It can get quite complicated when trying to work out the costs of buying a house. If the ins and outs of purchasing property has you in a spin, this simple holistic app could be your saviour.

Property Calculator Australia instantly gives a financial snapshot of a potential property purchase in just a few clicks.

This App has been patented, because it is one of a kind.

It offers flexibility and convenience, combining several useful calculators into one.

It is apportioned over two simple screens, so it is clear and concise. That gives users time to do more interesting stuff.

If changes occur in the industry that impact the calculations, the data in the app is updated in a timely manner to ensure that results are accurate.

Whether it’s someone’s first home or an investment property, they can see their major upfront costs, loan balance, stamp duty, loan repayments and more.

This app makes it easy to get on top of monthly repayments, whether the user is a numbers geek or not.

Key Features

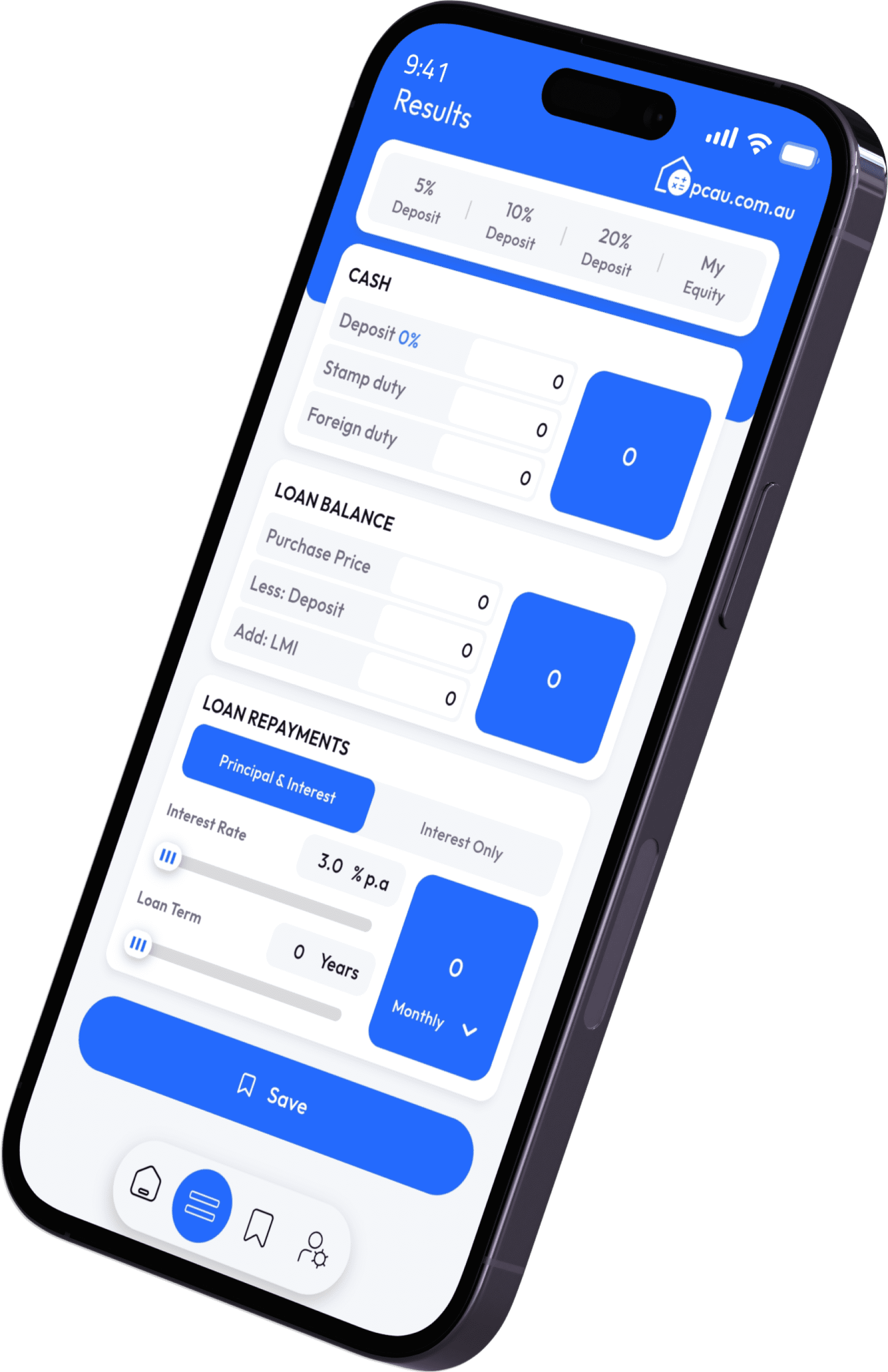

- One-page results: It has been simplified down to that one screen at your fingertips!

- How much do I need? Enter the purchase price and see the Stamp Duty and deposit amount – flick between 5%, 10% and 20% deposit (use cash or equity).

- Do I have enough? Customize the results based on your own cash using the “My Cash/Equity” function.

- See your loan balance, and exactly how it was calculated. Even Lenders Mortgage Insurance (LMI) is taken into account if the user wishes.

- Customize your Loan Repayments: Users can see their weekly, fortnightly and monthly repayments. They can choose between Principal & Interest or Interest Only repayments. They can even pick their own interest rate and loan term.

3rd Party APIs/SDKs/Libraries

- SendGrid

- Firebase Crashlytics

- Firebase Push Notification

- SQLite Database

With over 12 years of app development experience, we specialize in offering pertinent IT solutions for medium-sized businesses and corporations. We align with your goals, taking pride in our work and our clients.